SAMPLE PROJECTS

DEVELOPMENT FUNDS

Wyoming

DCN serves as manager of the Wyoming Smart Capital Network (WSCN). The Fund was launched to create jobs by helping small businesses in Wyoming gain access to capital. The WSCN was funded by the U.S. Department of Treasury as part of the State Small Business Credit Initiative (SSBCI). The WSCN consists of a coalition of 16 Wyoming municipalities that joined together to bring this capital resource to their communities. The fund provides both debt and equity.

wyosmartcapital.org

North Dakota

DCN serves as co-manager with Praxis Strategy Group of the Red River Corridor Fund (RRCF). The Fund was launched to create jobs by helping small businesses across North Dakota gain access to capital. The RRCF was funded by the U.S. Department of Treasury as part of the State Small Business Credit Initiative (SSBCI). The RRCF consists of a coalition of 36 North Dakota municipalities that joined together to bring this capital resource to their communities.

redrivercorridorfund.com

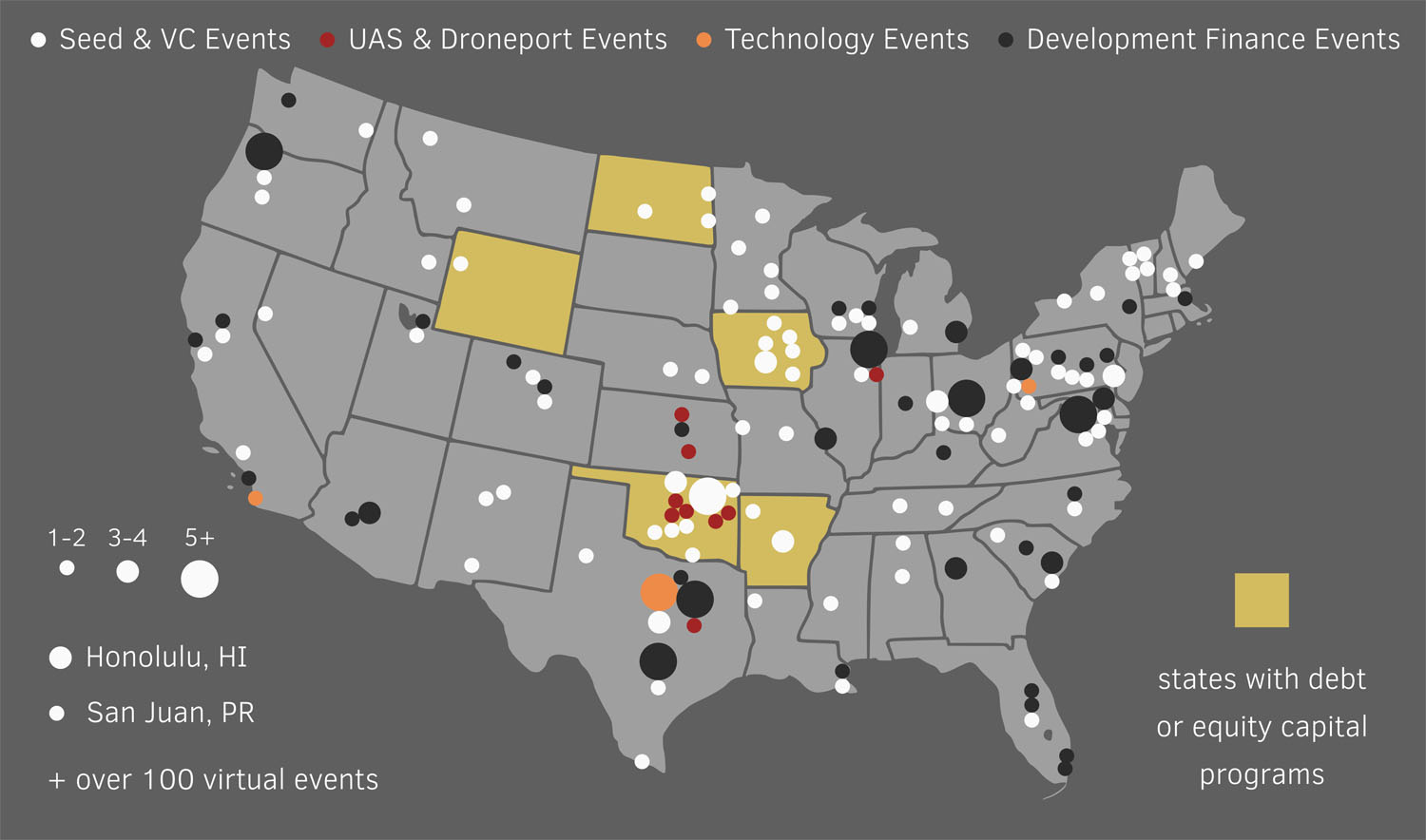

ANGEL NETWORKS

WBTangels is a network of angel funds that work together to invest in entrepreneurial ventures. Each angel fund has the opportunity to leverage a national network of technology, talent, and capital sources provided through the WBT Innovation Marketplace and other partners. All members have the chance to interact with entrepreneurs and contribute knowledge and time to analyzing, building and managing their group's portfolio.

WBTangels is facilitating angel funds in North Dakota, Oklahoma and Wyoming.

wbtangels.com

Cowboy Technology Angels

Cowboy Technology Angels is comprised of alumni and other friends of Oklahoma State University. We desire to see the wealth of research, innovation and talent developed at the university put to good work by investor-ready entrepreneurs and their young companies.

cowboytechnologyangels.com

UAS Angel Network

The UAS Angel Network is a collection of individual investors, angel groups and seed funds interested in becoming more knowledgeable about the unmanned aerial system industry for the purpose of increasing their investing acumen in that field.

uasangelnet.com

UAS CLUSTER INITIATIVE

DCN serves as manager of the Unmanned Aerial Systems Cluster Initiative of Oklahoma and Kansas (UASCI), funded in part through a contract with the U.S. Small Business Administration, accelerates the growth of the Unmanned Aerial System industry in the U.S. by enabling established companies and emerging entrepreneurs in Oklahoma and Kansas to connect, work together, and gain access to national technology, global capital, advanced business models and global markets.

uascluster.com

DRONEPORT NETWORK

The DronePort Network brings together community and thought leaders as well as entrepreneurial companies and government officials to unlock economic prosperity and create jobs in the emerging Unmanned Aerial Systems (UAS) industry. The Network enables collaboration, education, and advocacy for the purpose of shaping the future of droneport development.

droneports.org

OPEN INNOVATION

To compete in today’s global economy American business seeks new markets, new products, and new processes. Success often turns on gaining access to new technologies.

Open Innovation is a system for finding and acquiring new technologies from anywhere in the world to enhance a company’s product pipeline at home.

DCN produces Open Innovation events hosted by regional economic development organizations and industry groups. An Open Innovation Forum introduces the concepts and methods of Open Innovation to local companies, with a focus on an existing or emerging sector of strength within the region.

wbtoi.com

ASSOCIATION SERVICES

DCN provides executive leadership, program services, financial administration and information technology services to organizations concerned with economic and entrepreneurial development. DCN delivers accounting, tax prep and audit prep service for development funds, and a full suite of IT services for the Council of Development Finance Agencies.

COUNCIL OF DEVELOPMENT FINANCE AGENCIES (CDFA)

The Council of Development Finance Agencies is a national association dedicated to the advancement of development finance concerns and interests. CDFA represents public, private and non-profit entities engaged in development finance at local and state levels. In 2001 DCN was recruited by the CDFA board to help restart the organization. From that year through mid-2017, DCN provided the executive management for CDFA and the full complement of programs for members. DCN grew the member list from 80 to over 500 and produced hundreds of conferences, seminars and workshops. In 2017 the board accepted direct responsibility for the staff and programs.

cdfa.net

WBT INNOVATION MARKETPLACE

What began as an idea in early 2002, the WBT Innovation Marketplace (WBT) has served as a premier event showcasing a large collection of vetted and mentored companies and technologies emanating from top universities, labs, research institutions, and the private sector from across the country and around the globe.

The WBT Innovation Marketplace represents the collaborative, year-long effort of investors, licensees, and tech commercialization professionals. The WBT is deal-focused and diverse, showcasing companies and technologies that vary by geography, funding source, and type of research institution. Participating technologies, each supported by private funding, federal R&D grants or both. Technologies are selected by and presented to seasoned venture investors and Fortune 500 licensing scouts representing a variety of industries.

wbtshowcase.com

LATIN AMERICAN VENTURE CAPITAL ASSOCIATION (LAVCA)

The Latin American Private Equity & Venture Capital Association (LAVCA) (formerly the Latin American Venture Capital Association) is a not-for-profit membership organization dedicated to supporting the growth of private capital investing (including private equity, venture capital, and real assets) in Latin America and the Caribbean. Formed by DCN in 2002 at the request of the Inter-American Development Bank, DCN provided full executive staff and program services through 2010. During that time, founding execs Christina Kappaz and Ramona DeNies grew membership from zero to over 100, gained multi-year financial support from the Multi-Lateral Investment Fund, held annual conference and research forums and launched the annual benchmark analysis of country by country readiness for venture capital and entrepreneurial development. In 2010 direct responsibility for staff and programs was transferred to the board.

lavca.org

NATIONAL ASSOCIATION OF SEED & VENTURE FUNDS (NASVF)

NASVF brought together innovation capital leaders: private, public and non-profit organizations committed to building their local economies by investing in entrepreneurs.

NASVF began informally in 1993 as an ad-hoc group of practitioners seeking the best models to encourage capital formation in their states, particularly for new technology ventures. In 1997 the group incorporated and engaged members of the DCN Team as managers. DCN grew membership from zero to over 250, delivered over 100 field seminars on seed investing for new angels, and dozens of annual conferences and research workshops. In 2009 the board accepted direct responsibility for the staff and programs.

NATIONAL SCIENCE FOUNDATION (NSF)

The National Science Foundation awards SBIR/STTR grants to small companies to perform research and development. DCN has consulted with over 500 of these awardees as they made preparations to submit Phase II proposals. Services included mentoring, market research, assessing milestones, and proposal writing assistance toward development of a technology commercialization plan.

seedfund.nsf.gov

BIRD DOG INNOVATION STRATEGIES

Through its work in technology commercialization, DCN developed systems for facilitating the identification and transfer of technologies from research institutions to companies. This system included market and competitor analysis, advice on strategic patenting, partner identification and vetting, patent valuation, and license negotiation. The system was eventually bundled into a service and named Bird Dog Innovation Strategies. Jeff Carpenter, a valued employee at DCN who served as the point person on the system, purchased the Bird Dog business from DCN in early 2014.

birddoginnovation.com

30 YEARS EXPERIENCE IN 44 STATES AND 6 COUNTRIES